Bearish sentiment has taken hold of oil markets after OPEC+

underwhelmed

with its commitment to extend its voluntary cuts into Q3 2024

and its base cuts until the end of 2025.

- Combining an in-person meeting

in Riyadh with a hybrid online option for smaller producers, OPEC+

has agreed to extend existing production cuts into next year, whilst

also paving the way for a gradual unwinding of most curtailments.

- The last round of voluntary production cuts agreed in November

2023 are set to be phased out over a 12-month period, lifting OPEC+

collective target to 36.27 million b/d, more than 2 million b/d

higher than current output.

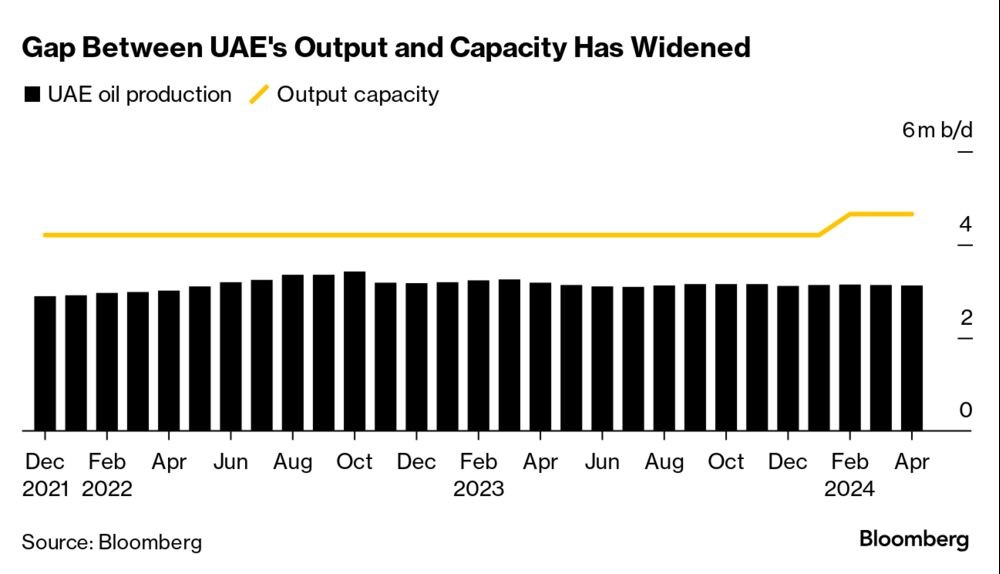

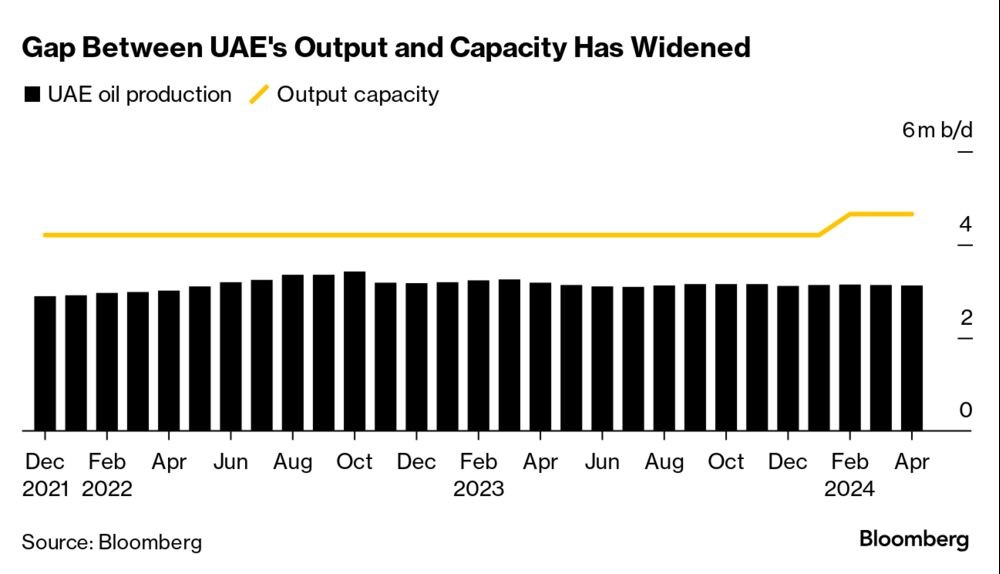

- The UAE was the big winner of the OPEC+ meeting, having secured

another upgrade to its official production quota, allowing it to

ramp up output by 300,000 b/d in several steps throughout 2025.

- Even though Saudi energy minister Prince Abdulaziz bin Salman

maintained that OPEC+ has the choice to pause or even reverse the

upcoming relaxations, the market at large saw it as a sign of more

supply in a period of uncertain demand.

Market Movers

- The shipping arm of ADNOC, the national oil company of the UAE,

has

agreed to

buy UK-based shipowner Navig8 for $1.5 billion, taking over a fleet

of 32 tankers and the operatorship of six shipping pools.

- US midstream major Energy Transfer (NYSE:ET) has

agreed to

buy Midland-focused pipeline operator WTG Midstream in a deal valued

at $3.25 billion, including a $2.45 billion payout in cash.

- Japan’s largest gas supplier Tokyo Gas (TYO:9531)

is

seeking

to invest into US natural gas assets, building on its recent $2.7

billion purchase of Rockcliff Energy and its 49% farm-in into

trading firm ARM Energy.

Tuesday, June 04, 2024

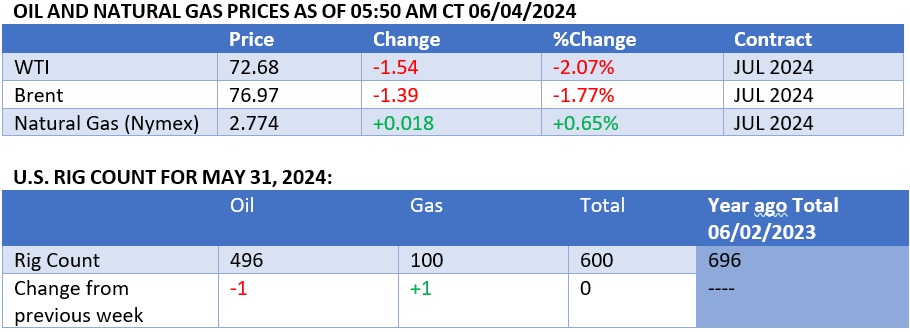

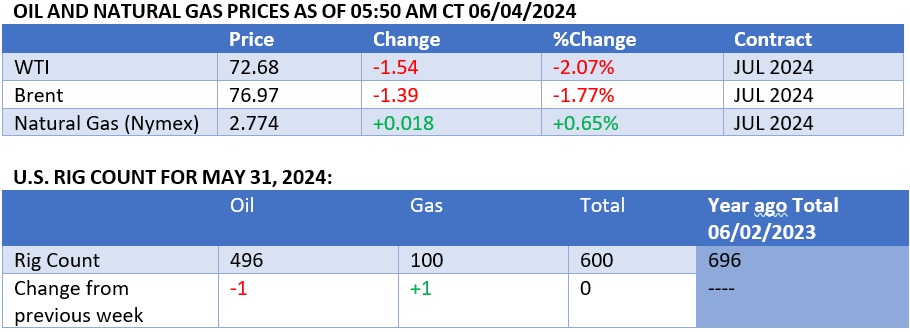

The OPEC+ meeting over the weekend extended voluntary production

cuts into Q3 2024 and the original 3.66 million bpd cuts until the

end of 2025. That pledge was not enough to persuade market

participants that the future of oil is bright, with Brent shedding

almost $3 per barrel in just one trading day and sliding below the

$77 per barrel mark. With the promise of more supply coming back to

market in 2025, the list of bullish factors out there has shrunk to

a bare minimum.

OPEC+ Extends Voluntary Production Cuts to Q3.

Swiftly organizing an in-person meeting in Riyadh, OPEC+

members

agreed to

extend the 2.2 million b/d of voluntary cuts until the third quarter

of 2024, whilst also charting the course for a gradual relaxation of

remaining cuts into 2025.

Norway Outage Sends European Gas to 2024 Highs.

European TTF gas futures

soared to

their highest this year so far, at €37 per MWh, after

Equinor's (NYSE:EQNR) offshore Sleipner hub halted

operations due to a crack, also prompting a shutdown at the Nyhamna

processing plant.

Nationwide Strike Paralyzes Nigeria’s Industry.

Nigeria’s main labor unions have

shut down

the country’s power grid and halted flights across the country as

they demand a 1500% increase in minimum wage amidst unprecedented

inflation, so far sparing the country’s oil production.

Hedge Funds Come Back to Oil Speculation.

After six straight weeks of shorting their positions, portfolio

investors have

ramped up

their net length held in the six main oil futures and options

contracts in the week ending May 28, mostly by closing out their

shorts ahead of the OPEC+ meeting.

South Korea May Have Found Oil. One of the

most import-dependent countries globally, South Korea has

approved

exploratory drilling for potentially huge oil and gas reserves off

the country’s east coast, with KNOC leading the appraisal that could

unearth as much as 14 billion boe.

Exodus of Oil Majors from UK North Sea Continues.

Global oil majors Shell (LON:SHEL) and

ExxonMobil (NYSE:XOM) are

nearing

an agreement with independent UK producer Viaro Energy to sell their

jointly-owned gas fields in the southern North Sea for $0.5 billion,

ending Exxon’s 60-year presence in the country.

Indonesia Postpones Copper Concentrate Export Ban.

Indonesia, one of the largest copper producers

globally, has

postponed

the start of a ban on its copper concentrate exports until the end

of 2024 due to delays in the construction of smelters, potentially

deflating copper prices into the summer.

US Resumes Buying Oil for SPR. The US

Department of Energy has

resumed

purchasing 3 million barrels of oil for the country’s Strategic

Petroleum reserve, buying at an average price of $77.69 per barrel

for November delivery, taking the repurchased total to 38.6 million

barrels.

Sheinbaum’s Landslide Victory Worries Mexico’s Oil

Industry. The landslide victory of Mexico’s

president-elect Claudia Sheinbaum will allow the ruling party to

officially

dismantle

the 2013 energy market liberalization by changing the constitution,

capping future oil production growth in the country.

Indian Heatwaves Ratchet Up Gas Consumption.

As heatwaves across India have claimed dozens of lives, the

country’s natural gas-based power generation has

surged to

record highs in May, almost doubling year-on-year to 4.7 million

KWhr, all the while coal still accounts for 75% of generation

capacity.

China’s Emission Rules to Cap Fuel Demand.

Beijing is set to mandate a 5% cut from 2020 levels of carbon

emissions intensity by the end of 2025, removing purchase limits on

non-fossil-fuel cars and boosting the electrification of industrial

vehicles, capping growth in gasoline and diesel demand.

US Oil Major Takes Venezuela to Court. A

court in Trinidad and Tobago has

granted

US oil major ConocoPhillips (NYSE:COP) the right to

enforce a $1.33 billion claim against Venezuela for the

appropriation of its oil and gas assets, potentially derailing the

development of offshore gas fields such as Dragon or Cocuina-Manakin.

Australian LNG Comes Back in Force. US

energy major Chevron (NYSE:CVX) has

resumed

LNG production at its Gorgon liquefaction facility on Australia’s

Barrow Island after a mechanical fault prompted a halt in operations

for a month, bringing back 5.2 mtpa of output capacity.

Tom Kool

Editor, Oilprice.com

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212