|

By Kyle Stock

Mr. Musk will juice you up — yes, even you Nissan and Porsche people

who have steered well clear of The Elon Show.

Tesla Inc.’s pledge to open its massive charging network to other car

brands later this year, while largely expected, nevertheless marks a

major inflection point in the electric vehicle economy and, should it

come to pass, will surely goose the pedal on EV adoption.

To date, Tesla has kept its plugs behind a walled garden because,

well, because it could. When it was getting started, there was no

incentive for anyone else to build and operate chargers, so it made

its own, understanding fully that the electricity was as important as

the electric vehicle. Simply put: plugs sold cars. As long as EV

dabblers like Chevrolet and Nissan didn’t have many of them, customers

had all the more reason to buy a Tesla.

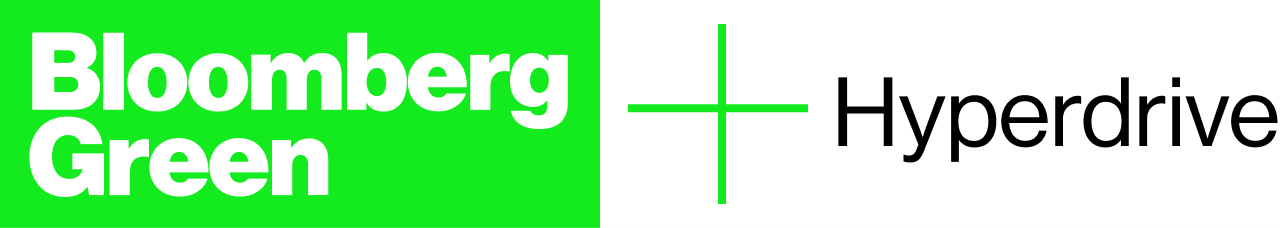

But with the coming parade of Tesla fighters came a surge in rival

charging networks like Electrify America and EVgo. Tesla’s charging

map is still arguably better than its rivals, but not by much.

In the U.S. and Canada there are 1,176 fast-charging Tesla stations,

compared with 5,113 stations operated by others, according to the

latest tally by the Department of Energy. However, there are 20% more

Tesla plugs and they are scattered more widely around the country, as

the company leverages them as business development machines, from the

badlands of North Dakota to the forests of Maine.

The most likely places for Tesla to drop its charging wall are in

Europe, where it faces much

more robust

rival networks and stands to gain subsidies for brand-agnostic plugs.

In Europe, Tesla owns just 16% of the public fast chargers and, not

surprisingly, many Tesla vehicles on the continent are equipped with

the more generic CCS charging port, rather than the company’s

proprietary dock.

Meanwhile, in his home market, Musk’s hand has been further forced by

his rivals, as competing car companies cobble together partnerships —

known as interoperability agreements – that allow their customers to

plug in to almost any network. Ford’s hodgepodge charge map, dubbed

FordPass, comprises 16,000 stations, including those run by Electrify

America and EVgo. Most of Montana and

Wyoming is still a bridge too far for a Mustang Mach-E in the wild,

but the rest of the country is fairly well wired.

In short, Tesla’s chargers are no longer as powerful at selling cars;

Musk may as well use them to sell some electricity. No doubt, he’ll

also use them to squeeze some hefty access fees out of FordPass and

other electric vehicle startups like Stellantis and Volkswagen. If the

service is good, the company eventually might lure some drivers away

from their Chevrolet Bolt or Volkswagen ID4. “There’s certainly a

marketing aspect to it,” says BloombergNEF analyst Ryan Fisher.

There’s no telling when, where, or even if Tesla will knock down the

wall around its chargers. The latest pledge came from Musk’s Twitter

feed, historically a somewhat unreliable source.

And if the company does welcome other

brands, there will likely be some elaborate queueing system to give

priority to the Tesla faithful. But the Supercharger network finally

has viable competition, albeit a collective one, in the minds of car

buyers and, apparently, in the mind of Elon Musk.

Wyoming may see a few more Mustangs in the wild after all. Giddy up.

If you're a Bloomberg Green subscriber and want to start getting our

Hyperdrive newsletter about electric vehicles,

sign up here.

If you're a Hyperdrive subscriber and want to start getting our daily

Green newsletter,

sign up here.

Like getting the Green Daily newsletter? Subscribe

to Bloomberg.com for unlimited

access to breaking news on climate and energy, data-driven

reporting and graphics, Bloomberg Green magazine and more. You

can read today’s newsletter on our website

here.

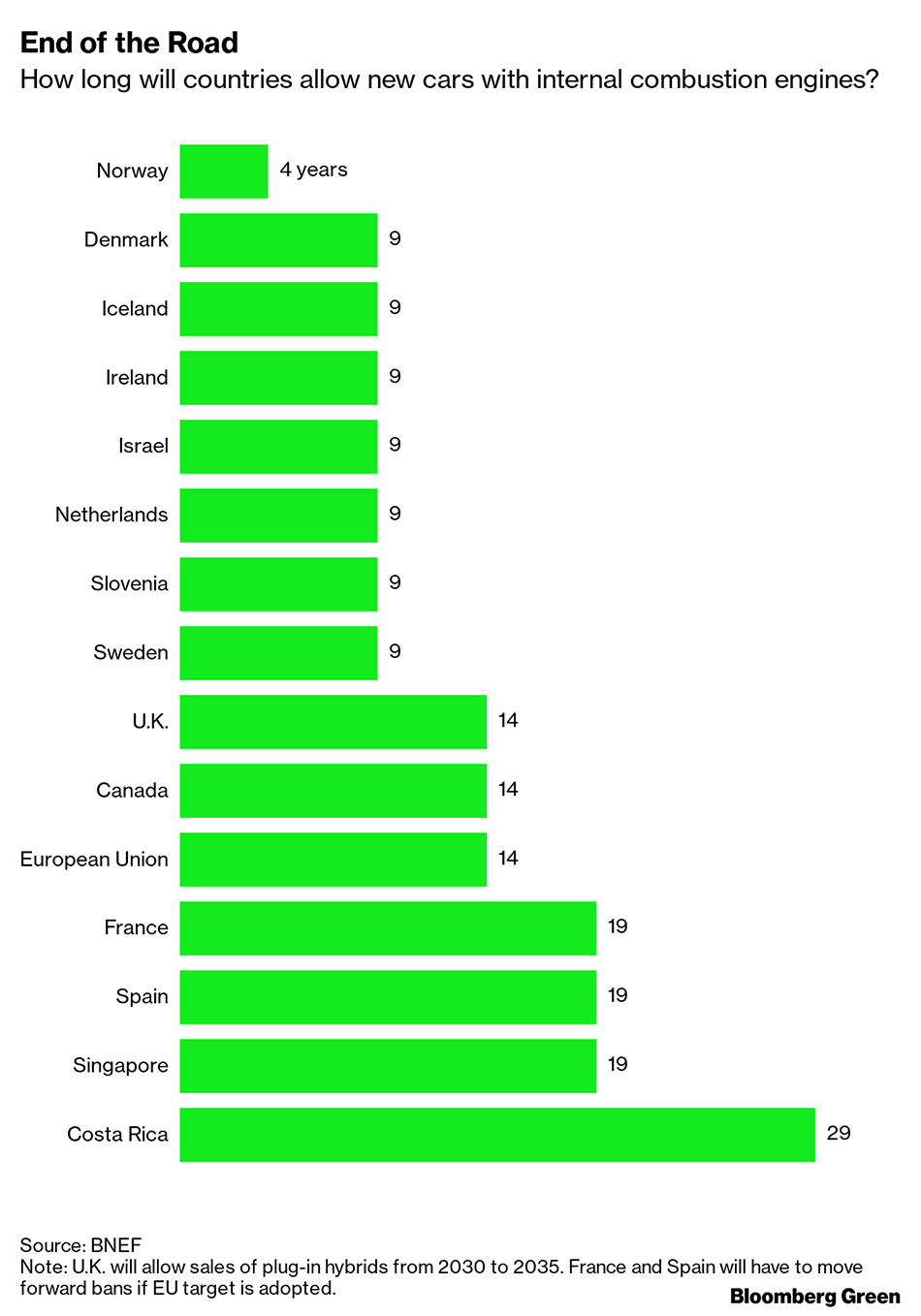

The European Union’s push to ban

new combustion-engine cars by 2035 was

only the latest

government move to phase out gas-guzzling automobiles. In Europe, it’s

just one part of a

massive overhaul

that will touch almost every aspect of daily life. Mercedes-Benz

vowed to spend

more than 40 billion euros ($47 billion) this decade to meet the

historic industry transformation, joining

other carmakers

that are investing tens of billions to accelerate their shifts to

electric.

·

The future of space is bigger than

Bezos, Branson or Musk.

Bugatti

will soon become

like a Patek Philippe wristwatch.

Bentley

unveiled

its second-ever plug-in vehicle.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|