Environment

Despite a drop

in clean-energy stocks and intensifying concerns about widespread

greenwashing, the market for investment products sold as being ESG-related

had another record year by most yardsticks.

Despite a drop in clean-energy stocks and intensifying concerns about

widespread greenwashing, the market for investment products

sold as being ESG-related had another record year by most yardsticks.

Issuance of

sustainable loans and bonds, where proceeds are supposedly

earmarked for environmental projects or to further a company’s social

goals, exceeded $1.5 trillion, including about $505 billion of green

bond sales; ESG-focused

exchange-traded funds attracted almost $130 billion in

2021, up from $75 billion a year ago; and investment in early-stage

climate tech companies approached $50 billion.

It also was a year of big fees for U.S. managers of sustainable funds,

with

revenue climbing to almost $1.8 billion from $1.1 billion

in 2020, according to data compiled by researchers at Morningstar Inc.

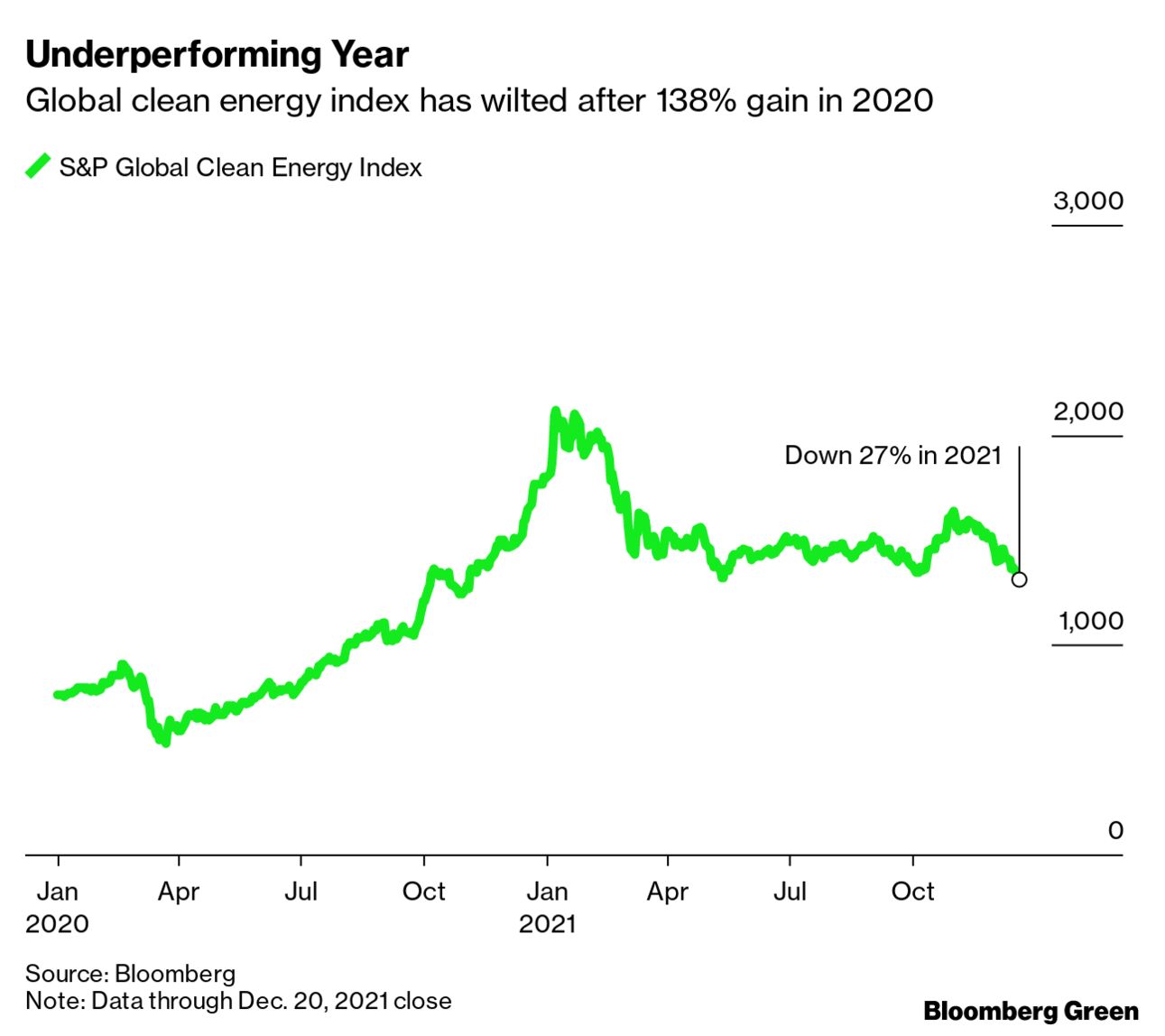

But not everything went one way. The

S&P Global Clean Energy Index, which includes companies

like wind-energy giant Orsted AS, Spanish utility Iberdrola SA and

Sunrun Inc., the largest U.S. residential-solar company, has declined

27% so far in 2021, after more than doubling in value last year.

The outlook for green stocks is challenging because of worries about

rising interest rates tied to inflation, unpredictable U.S. politics

and regulatory maneuvers like

California’s decision to sharply lower subsidies and add

new fees for home solar users, said Sophie Karp, an analyst at KeyBanc

Capital Markets.

“Despite long-term growth prospects, there is

waning enthusiasm for the sector,” she said.

Adeline Diab, head of ESG research for EMEA and the Asia-Pacific

region at Bloomberg Intelligence, agreed. On Dec. 21, she wrote:

“Despite mounting catalysts with the U.S. infrastructure plan and EU

taxonomy requirements, the clean-energy sector may remain exposed to

uncertainty linked to government support such as stimulus delays or

incentives-cuts announcements, the most recent being in California.”

Shares of renewable energy stocks hit another speed bump this week

when U.S. Senator Joe Manchin, a conservative Democrat from coal state

West Virginia, shocked his own party by announcing his

opposition to President Joe Biden’s economic plan, which

includes a landmark investment in the fight against global warming.

Manchin, whose vote in an evenly-split Senate was needed in the face

of universal Republican opposition to significant efforts to fight

global warming, has undermined Biden’s bid to address the climate

crisis.

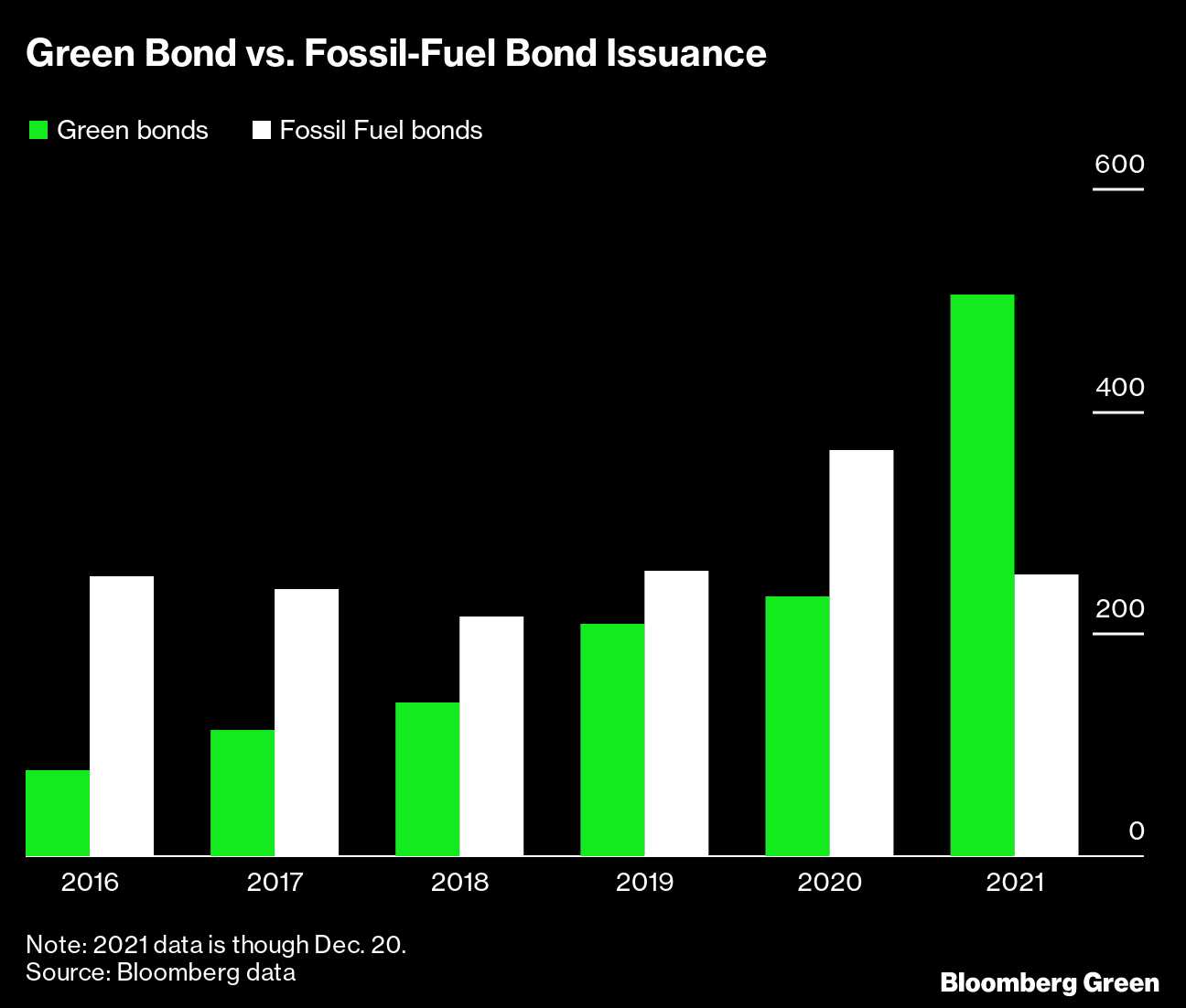

Even with the stock market slide, this year was still the first since

the Paris climate agreement in late 2015 that

more money went into green bonds than debt issued by oil,

gas and coal companies.

And next year is shaping up to be bigger. Analysts at Morgan Stanley

estimate that green bond issuance will approach $1 trillion in 2022,

led by sales from the European Union.

Bank of America Corp., the biggest corporate issuer of U.S. bonds sold

as being tied to environmental, social and governance factors, also is

predicting another big year for global sales of the debt.

“Will ESG primary issuance market double again in 2022? We’re not

making that prediction,” said Karen Fang, the bank’s global head of

sustainable finance, in an interview last week. “But we do think it

will grow very, very strongly given the momentum behind the global

net-zero transition and investor demand.”

Emmanuel Roman, chief executive officer of Pacific

Investment Management Co. (PIMCO), at the Milken Institute Global

Conference in Beverly Hills, California, on Oct. 18.

Photographer: Kyle Grillot/Bloomberg

Bloomberg Green publishes Good Business every week, providing unique

insights on ESG and climate-conscious investing.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

Nathan1@greenplayammonia.com

exactrix@exactrix.com

|