|

24 April 2023

For the past

week our Green Daily newsletters have focused on the climate tech set

to decarbonize world economies, featuring

winners of

BloombergNEF’s Pioneers awards. The coverage has led up to BNEF’s two-day

summit, which starts today. Click

here to follow our rolling update. Terminal subscribers can also

watch events at

LIVE <GO>. Later in the week, Bloomberg Green will hold our own

summit. You can attend virtually by

registering online. Today’s newsletter — the final one in our

special climate tech series — is about the money moving the green

transition. We take a deep dive look at who’s investing and where

they’re putting their money.

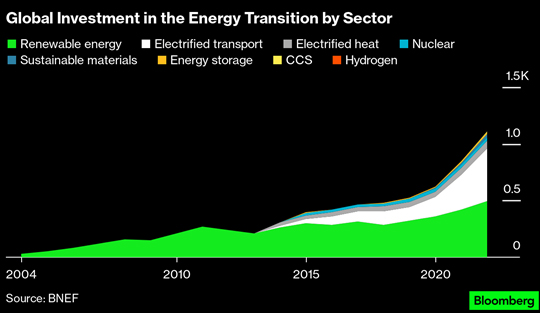

Following the $1.1 trillion climate tech boom

By

Eric Roston and

Akshat Rathi

Click here to read the full version of this story on Bloomberg.com.

Big money — from the three biggest economies in the world, as well as

scores of ambitious venture capitalists — is suddenly flying toward

startups promising to help the world build a carbon-free future.

It’s a shift from the world of software into the actual world,

following the trajectory of a tech founder like Peter Reinhardt, who

sold a software company for $3.2 billion in 2020 and now leads

carbon-storage company Charm Industrial. The newer startup, which he

co-founded in 2018, turns carbon-rich biomass into sludge that can be

safely buried underground. “We need to rebuild almost all the

infrastructure around us to eliminate fossil fuel emissions and return

the atmosphere to pre-industrial CO2 levels,” Reinhardt says. “That

will require a tectonic shift.”

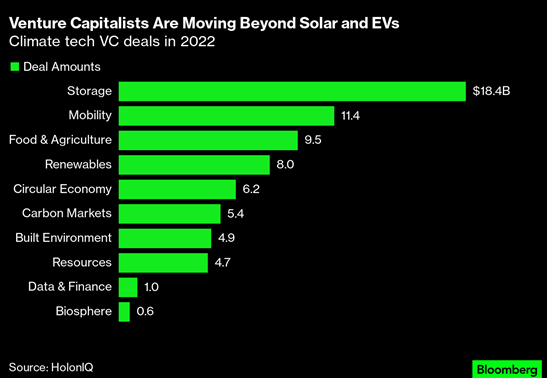

That’s why horizon-scanning investors are suddenly less interested in

reseeding yesterday’s innovations (solar, wind and lithium-ion

batteries) than doing deals that push forward the frontiers of climate

tech. Decarbonized food, carbon-removing contraptions, futuristic

materials and next-generation fuels are now portfolio targets for

venture capitalists.

For early-stage investors, solar panels and electric vehicles are so

2011. By now these are relatively mature products built on the work of

previous decades. They’re doing the job they were built for: gradually

replacing fossil fuels. In fact, solar and wind are cheaper than coal

in most of the world today. That means market forces will turn power

grids a deeper shade of green with each passing year, and VCs can

focus on electrifying everything else.

“There is capital available for great entrepreneurs — and good

entrepreneurs — to tackle really hard problems in a way that wasn’t

available in that first wave” of renewables investment, says Gabriel

Kra, co-founder of Prelude Ventures. During the last 15 years, he

adds, “the core technologies have changed, the participants have

changed, the capital availability has changed, the building blocks

have changed. And that’s what’s leading to this second, more

successful wave of innovation.”

Investors won’t be working alone. Many of the most exciting startups

combine private and public backing. Examples abound, despite a tech

downturn that’s eliminated more than 120,000 jobs from the sector in

the US and a banking crisis that’s taken down VC favorite Silicon

Valley Bank.

Venture capital investment in climate tech reached a record $70.1

billion last year, according to HolonIQ Global Impact Intelligence.

That was an enormous 89% rise over 2021 at a time when overall VC

investment retreated, the tech sector shed jobs and Russia’s war in

Ukraine spiked oil and gas prices and unleashed a scramble for fossil

fuels.

Early-stage financiers are standing up against a backdrop of

government, corporate and consumer spending on emissions reductions

and adaptation measures. A balance of forces — investor enthusiasm

backed by public-sector spending, facing off against global economic

headwinds — will be a major topic of discussion during the two-day BloombergNEF

Summit on the energy transition in New York this week.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|