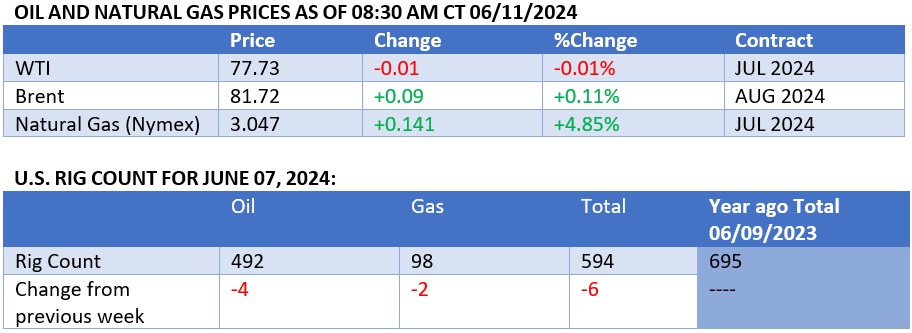

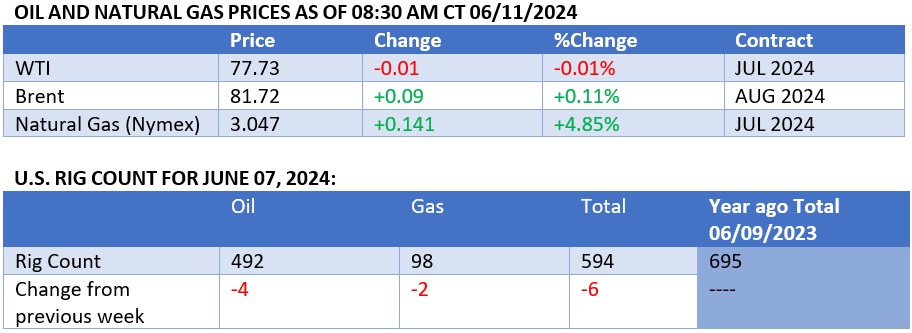

Bullish sentiment appears to be building in oil markets as summer

demand for fuel kicks in, pushing Brent back above the $81 per barrel

mark.

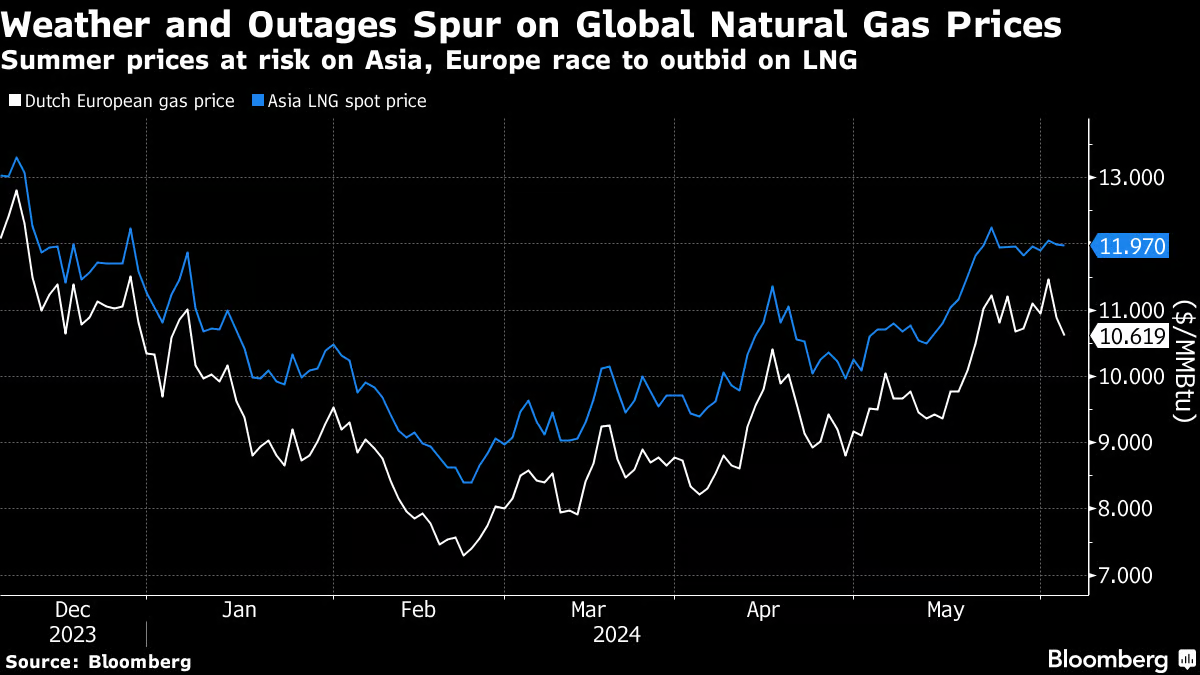

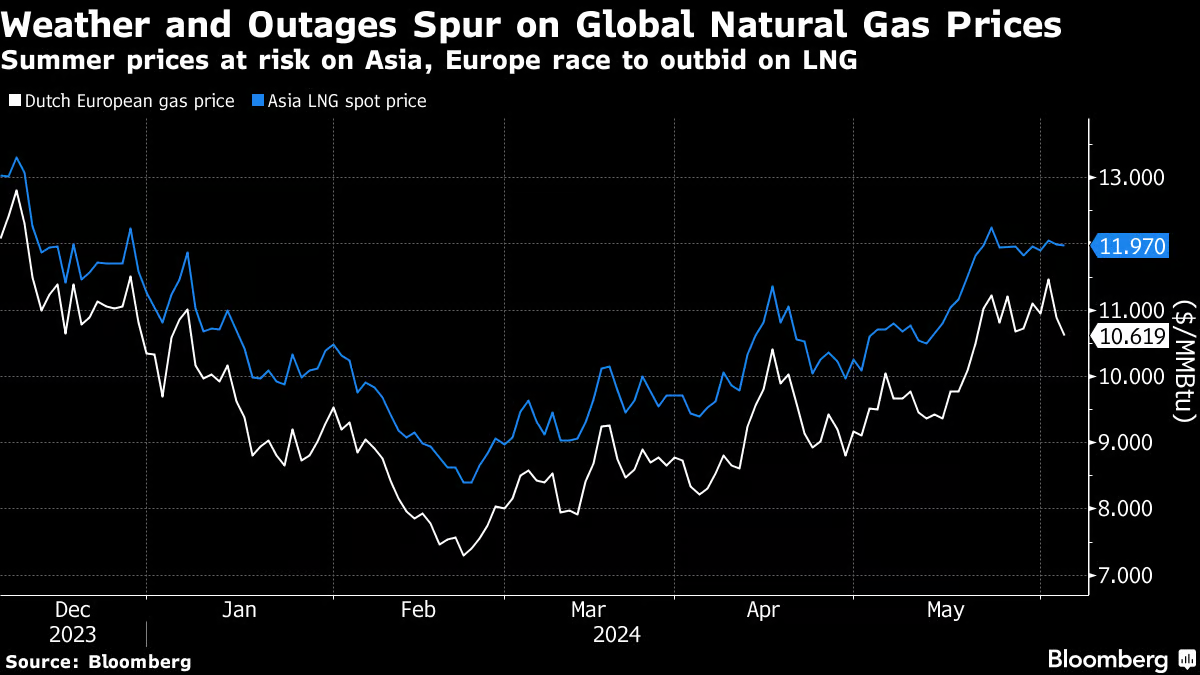

- Supply disruptions have ratcheted up

pressure on gas prices globally, with prices across Europe, Asia, and the

United States simultaneously edging higher to their highest in 2024 so

far.

- European TTF gas futures soared 13% in one day after cracks were found

in Equinor’s Sleipner platform and even though the repairs concluded

already, the regional benchmark

continues to

hover around €35 per MWh ($11 per mmBtu).

- A string of Australian force majeure events, the latest of them coming

from Chevron’s Wheatstone facility which was forced to halt production

after an outage this Monday, has pushed the regional LNG prices to $12 per

mmBtu already.

- Sentiment arpund natural gas in the US has improved markedly, too, with

Henry Hub closing above $3 per mmBtu for the first time since early

January 2024 and hedge funds’ positioning turning sustainably net long

after two years of suffering.

Market Movers

- Global trading major Glencore (LON:GLEN) has won a

crude supply tender to Prax’s 113,000 b/d Lindsay refinery in the UK,

dealing a painful blow to trading competitor Trafigura which used to be

Prax’s main supplier.

- Warren Buffett’s Berkshire Hathaway (NYSE:BRK)

bought some

2.57 million shares of common stock in Occidental Petroleum (NYSE:OXY),

further increasing its ownership of the oil majors from the 28% stake it

had up until now.

- French major TotalEnergies (NYSE:TTE) agreed to

purchase the UK power generator West Burton Energy from EIG for a total of

$576 million,

boosting its

gas capacity by 1.3 GW and renewables by 1.1 GW.

Tuesday, June 11, 2024

Following weeks of lukewarm demand statistics, we might finally be on the

brink of seeing summer demand kicking in. A reported jet fuel shortage in

Japan, Goldman Sachs’ relatively bullish view on transportation fuel

demand over the summer, and the prospect of a US SPR replenishment boost

have lifted Brent futures above the $81 per barrel mark.

Return of OPEC+ Barrels Triggers Huge Sell-Off.

Portfolio investors

exited a record

amount of long positions in the week ending June 4 as the prospect of

OPEC+ bringing back production into 2025 soured the bullish sentiment,

selling a total of 194 million barrels in the six leading futures

contracts.

Iraq Eyes Restart of Idled Kurdish Pipeline.

Iraq’s oil minister Hayan Abdel-Ghani noted

progress in

negotiations with Kurdistan regional officials on a potential deal to

resume oil exports via the idled 450,000 b/d capacity Kirkuk-Ceyhan oil

pipeline, halted since March 2023.

Saudi Aramco SPO Exceeds Expectations. The

shares of Saudi national oil company Saudi Aramco (TADAWUL:2222)

gained this week after the company

raised $11.2

billion in its secondary share offering, with at least half of sales

reportedly going towards international investors.

New Zealand Makes U-Turn on Oil Exploration. The

government of New Zealand

vowed to

introduce legislation that would remove a disputed ban on offshore oil

exploration, in place since 2018, by the end of this year, reversing the

oil policy of the previous center-left Labour government.

Niger-Benin Spat Turns Ugly Again. Having just

loaded the first-ever Meleck cargo last month, exports could halt again as

the Benin-Niger geopolitical spat took another turn this week, with the

former arresting 5 people it believes to be Nigerien soldiers working

undercover at the port of Seme.

Japan to Fund New Nuclear Plants with Bonds.

Japan’s Kansai Electric Power is

planning

to issue transition bonds to finance future nuclear power projects,

aiming for some ¥30 billion ($190 million), the second Japanese firm in

two months to turn to bonds as a nuclear financing tool.

Russia Seeks Iran Corridor to India. Russia has

announced it plans to export coal to India via Iran’s railway network

system as Moscow seeks to ramp up supplies to the world’s second-largest

coal consumer, to be ultimately shipped from the Iranian port of Bandar

Abbas.

Houthis Strike Two Western-Owned Container Ships.

Houthi militias have

targeted two

container ships this week, the Swiss-owned Tavvish and the German-owned

Norderney, damaging both with anti-ship ballistic missiles some 70

nautical miles southwest of Aden.

Suncor Triggers the Ire of Environmentalists.

Environmentalist

groups sued

Canada’s leading oil firm Suncor Energy (TSO:SU) for

alleged air pollution violations at its 98,000 b/d Commerce City refinery

in Colorado, claiming they’ve recorded more than 1,000 emission violations

in 2019-2023.

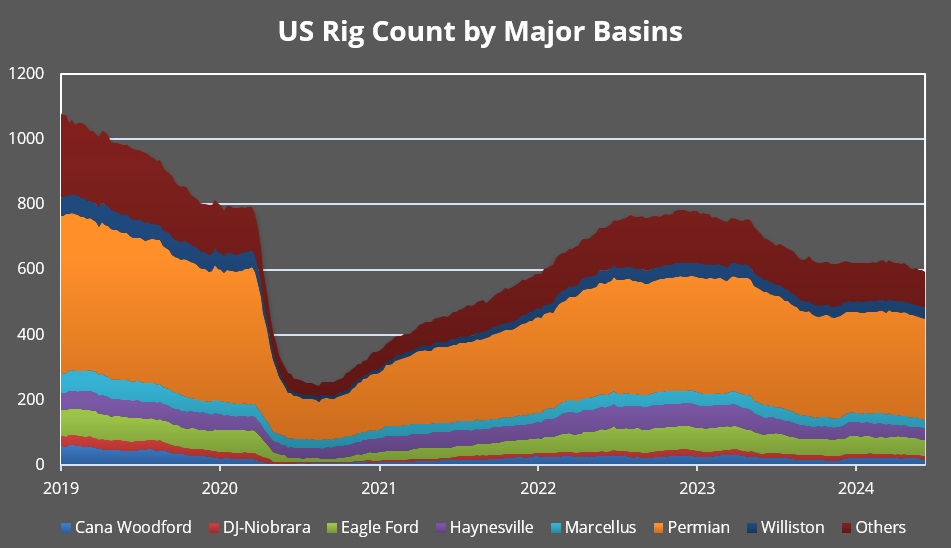

IEA Sees Upstream Investment Growth Slowing Down.

The International Energy Agency

forecasts that

global upstream spending would increase by 7% this year to $570 billion,

slightly lower than the 9% year-on-year pace of 2023, insisting that it’s

much more than is needed.

Chinese Demand for Saudi Crude Weakens. Saudi

crude exports to China are

expected to

bottom out in July as Chinese refiners nominated only 36 million barrels

for next month, opting for other sources of crude as Middle Eastern

barrels get more expensive as margins flatten out.

Port of Baltimore Fully Reopens After Tanker Crash.

Less than three months after the Dali tanker crashed into the Francis

Scott Key Bridge the port of Baltimore has fully reopened as the operating

dimensions of the navigation channel were lifted to 700 feet wide and 50

feet deep.

Oil Sands Producers Riot Against Emissions Cap.

Canada’s leading oil producers have

objected to the

government’s plan to cap emissions, saying that a carbon tax would be the

preferred way of climate impact mitigation, as limiting emissions would

also impact future production growth.

Tom Kool

Editor, Oilprice.com

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212