|

Hydrogen Pipeline System Is

Starting To Take Shape In Europe

By Rystad

Energy

April

4th, 2023

-

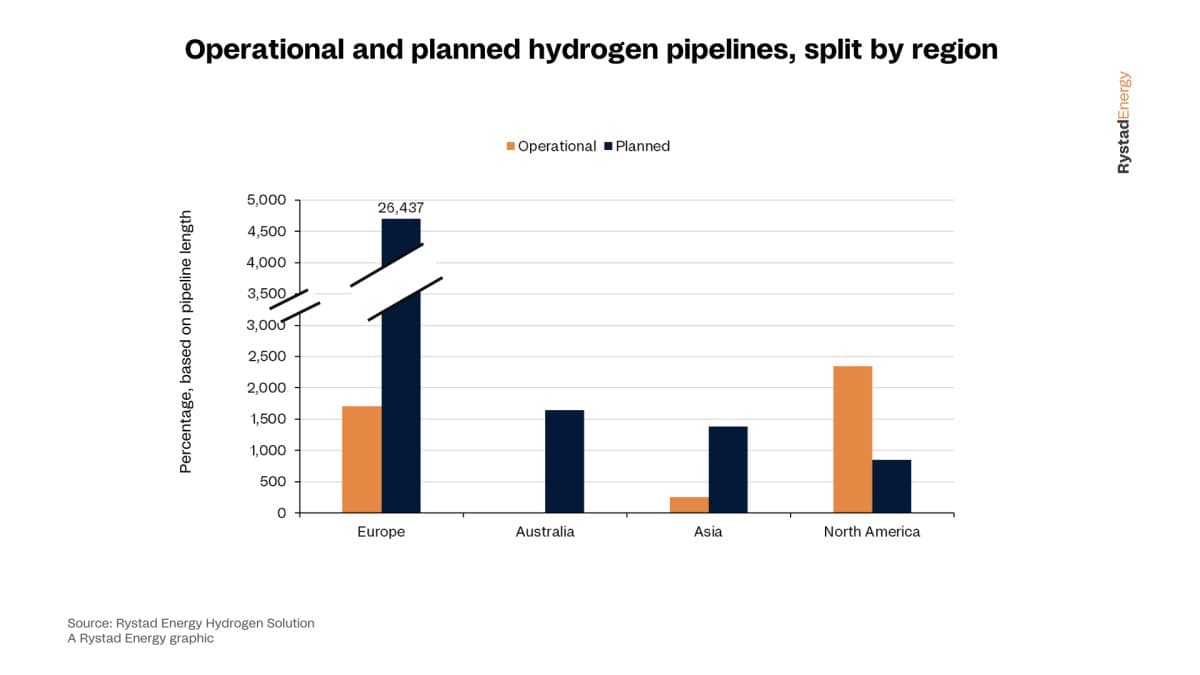

Rystad: Over 4,300 kilometers

already exists for hydrogen transportation with over 90% located in

Europe and North America.

- Globally,

Europe is at the forefront of efforts to produce and import green

hydrogen.

- The

construction of new dedicated hydrogen pipelines will be

complemented with repurposing of existing gas networks.

New hydrogen infrastructure is starting to materialize as the world

seeks to accelerate its path to net zero. There are very few shortcuts

to a sustainable future and simply switching existing oil and gas

infrastructure to hydrogen is not always viable. At the heart of this

challenge is physics, hydrogen has a high gravimetric energy density

and a low volumetric energy density. This means that among options,

hydrogen pipelines will be far better than vessels at moving hydrogen

over short to medium range distances. Today,

over 4,300 kilometers already exists for hydrogen transportation with

over 90% located in Europe and North America. Rystad Energy estimates

that there are about 91 planned pipeline projects in the world,

totaling 30,300 kilometers and due to come online by around 2035.

In cases where hydrogen will be shipped (as hydrogen or its

derivatives), it will eventually be distributed on land using hydrogen

pipelines, which makes transport via pipelines a critical

transportation mode for the gas. Hydrogen pipelines are already used

to supply industrial hubs (at petrochemical plants for example). As

supply scales up and moves from areas with abundant and renewable

energy to demand centers, long transmission lines will be a necessity

and these pipelines would require larger diameters and higher pressure

for cost effectiveness and consequently higher steel grades

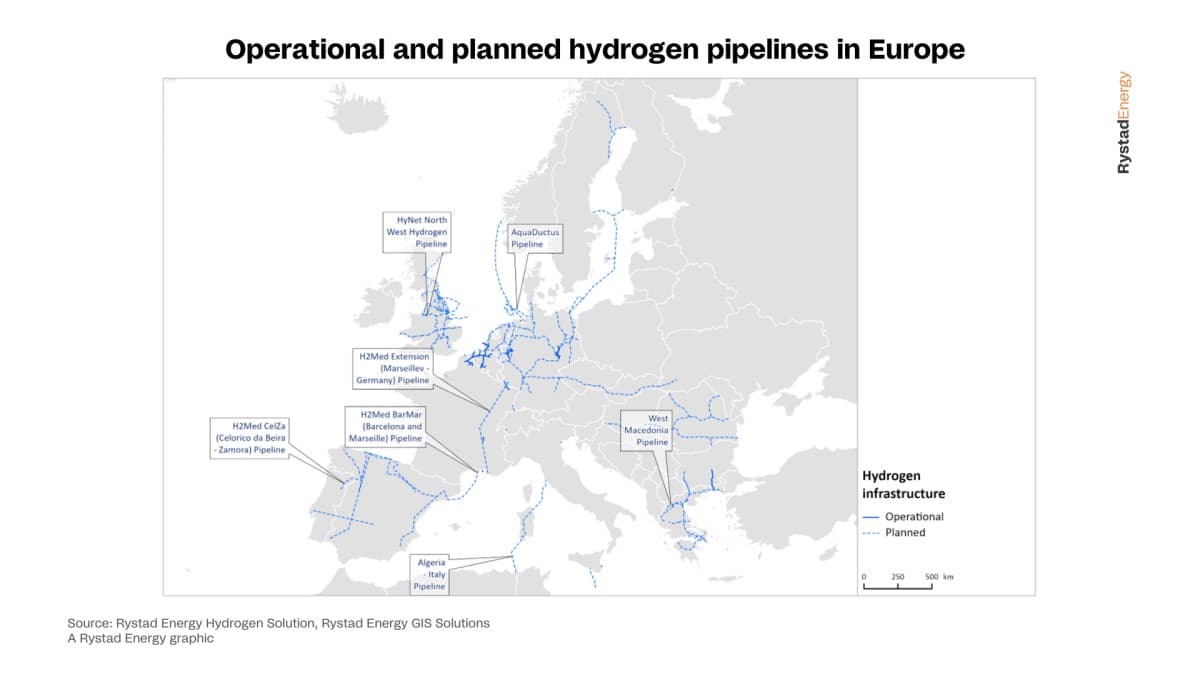

Globally, Europe is at the forefront of efforts to produce and import

green hydrogen and its attention is now turning to building the

necessary infrastructure to get it to demand centers. According to

Rystad Energy research, Spain, France, and Germany are among the

countries committed or considering cross border pipelines to

facilitate energy flows, while the UK with its extensive gas grid

finds itself in a fantastic position to switch from natural

gas to

hydrogen.

Related: The Clean Energy Subsidy Dispute That Could Define Europe's

Future

The steady increase in pipeline projects for hydrogen is an early sign

that the energy transition is gathering pace. Europe, with its

extensive gas grid is well placed to make the jump. Switching

infrastructure from gas to hydrogen is possible and cost effective.

But the greatest barrier is not financial, but the physical properties

of hydrogen itself which differ substantially from oil and gas. Says

Lein Mann Bergsmark, senior analyst, hydrogen.

Europe’s hydrogen pipeline network will knit the region together

Hydrogen is a key pillar in the EU’s decarbonization as laid out in

its hydrogen strategy in 2020, and its deployment received a boost

with the ‘Fit for 55’ package. It also plays a central role in the

REPowerEU Plan to phase out Russian fossil fuel imports – which aims

to produce 10 million tonnes of renewable hydrogen by 2030 and import

another 10 Mt in the same time frame. Considering proposed green

hydrogen projects in the EU, we are currently at 7.9 Mt of local

supply with startup by 2030 (or only 2.1 Mt from target), with nearby

supply amounting to 1 Mt in the rest of Europe – primarily UK and

Norway – and another 1 Mt in the Middle East. Additionally, 3.4 Mt of

proposed projects are in Africa, which could supply the largest

amounts of hydrogen to Europe – by ship or pipeline. To plan for the

distribution of these within the bloc, the European hydrogen backbone

(EHB) initiative, which is a group of 31 European gas transmission

system operators (TSOs), has published a vision paper for the future

hydrogen pipeline infrastructure. This is based on national analysis

of availability of existing natural gas infrastructure, future natural

gas market developments, and future hydrogen market developments.

According to the EHB’s 2030 hydrogen infrastructure map, a total

length of ~28,000 km in 2030 and 53,000 km by 2040 is envisioned in

the 28 European countries involved. Currently, dedicated hydrogen

pipelines that will be available by 2030 amount to 23,365 km, which is

83% of 2030 target. Rollout of hydrogen pipelines in Europe would be

gradual and the project start of transmission or distribution

pipelines will depend on the demand.

France, Spain, and Germany

Europe is taking the lead globally with pipelines planned on and

offshore. The recently announced H2Med Barcelona-Marseille subsea

hydrogen pipeline is budgeted to cost around $2.1 billion for a

stretch of 450 km and it was recently announced that it will be

extended to Germany too. Four grid operators – Spain’s Enagas,

Portugal’s REN, and French pair GRT and Terega – are currently

conducting technical studies, potential pipeline layouts and cost

assessments. Germany’s first offshore hydrogen pipeline project,

AquaDuctus, will transport green hydrogen from offshore wind

installations in the North Sea to Germany. The pipeline stretches over

400 km and according to one of its project partners, RWE, is said to

be the most cost-effective option for transporting large volumes of

energy over distances of more than 400 kilometers, compared to

transporting power from a High Voltage Direct Current (HVDC)

transmission system. For this reason, the option to transport power

onshore using power cables is excluded.

Greece

The West Macedonia pipeline is a new natural gas pipeline that started

construction in Greece earlier this year. It was designed to be

capable to safely carry 100% hydrogen at a later stage at

high-pressure through high-strength steel pipelines with large

diameters. Greek gas transmission system operator DESFA will operate

this 163-km pipeline, which is part of the EHB initiative.

The construction of new dedicated hydrogen pipelines will be

complemented with repurposing of existing gas networks. According to

the EHB, 60% could be repurposed by 2040, while according to pipeline

projects in the works, this currently accounts for 40%.

New build pipelines will be needed but may face a range of hurdles

concerning traffic movements, construction management and

environmental protection, especially if it stretches long distances

and goes through residential areas. For example, Cadent’s new 125 km

HyNet North West pipeline in the UK could hinder the development of

the project. HyNet will produce, store, and distribute hydrogen, in

addition to capture and store carbon from industry in the Northwest.

The pipeline, which could be UK’s first 100% hydrogen pipeline at

scale, is set to distribute hydrogen produced at Stanlow Manufacturing

Complex to several industrial gas customers across the region.

However, the regulatory model for hydrogen pipelines in the country

hasn’t been agreed upon yet, and Warrington Council, one of the local

authorities on the pipeline’s route, claimed it would disrupt a local

housing development.

Repurposing of pipelines offers a compelling alternative from an

economic perspective, and can be fast-tracked too, compared with

laying down new pipelines. Europe has an extensive gas grid and

repurposing this for hydrogen as gas declines will breathe life into a

system that might otherwise have gone to rust. After modifications,

repurposed steel natural gas pipelines can accommodate 100% hydrogen

gas. However, when hydrogen is blended with gas, the percentage is

restricted to about 20% where its end-use purpose is direct or

indirect heating.

Repurposing natural gas

pipelines

Relevant studies estimate utilizing existing natural gas grids for

hydrogen transport is four times more cost-effective than constructing

new pipelines. There are only limited differences in operating

expenses between a hydrogen transmission network based on repurposed

natural gas pipelines and a hydrogen transmission network made up

entirely of new pipelines. Given that transportation is generally

heavier in terms of capital expenditure than operational costs, this

could also be a reason why there is limited difference in transporting

hydrogen instead of natural gas.

The feasibility of repurposing natural gas pipelines revolves around

overcoming technical concerns related to pipeline transmission, which

include hydrogen embrittlement of steel and weld, hydrogen permeation

and leakage. The ability of hydrogen to dissociate on metal surfaces,

dissolve into the metal lattice and to change the mechanical response

of the metal leads to hydrogen-assisted fatigue and fracture, a

process called hydrogen embrittlement, which poses a substantial

challenge to existing steel natural gas pipeline. The small molecules

of hydrogen can permeate the material resulting in leaks. To overcome

the challenges of transporting hydrogen, coating, sleeves, and casing

of material with adequate resistance to hydrogen embrittlement and

permeation can be used, but to date this has not been tested on a

commercial scale in transmission pipelines.

There is a strong potential for using reinforced thermoplastic pipes (RTP)

in distribution pipelines for hydrogen as RTP can be obtained in

lengths that are substantially longer than steel, and the installation

cost for RTP pipelines is around 20% cheaper than for steel pipelines.

In the UK, 62.5% of the existing gas distribution network has been

upgraded with polyethylene inserted into the iron pipe, and most of

these networks are considered for future hydrogen use. Due to safety

concerns, large parts of the distribution network of iron pipelines

will gradually be upgraded as part of the UK iron gas mains

replacement program and it is estimated that 90% of the legacy gas

distribution network will use polyethylene by 2032. This means that

serendipitously, the UK in a good position to fast-track distribution

of hydrogen by pipelines when and where that is needed.

Nevertheless, a recent study by Open Grid Europe together with the

university of Stuttgart, concluded that existing steel pipelines

installed in the German gas network are “hydrogen-ready” and can

already carry up to 100% hydrogen. They were found to “possess no

differences in terms of their basic suitability for transporting

hydrogen compared to natural gas”. This applies to all steel grades

used in gas pipelines over Germany and in some other parts of Europe.

As part of the research, samples of the types of steel used in German

pipelines were subjected to exhaustive measuring methods that, in

contrast to previous studies, considered additional variables such as

the influence of hydrogen pressure. However, discussions with pipe

manufacturers have shown that some of them find the study’s conclusion

optimistic. Hydrogen embrittlement may affect the pipes depending on

their metallurgical and mechanical properties and the current

condition of the pipe, after years in service. As a result, Rystad

Energy expects more variability in terms of existing pipeline

suitability to carry hydrogen. Even though this conclusion covers only

pipes, and not the compression, valves, or other components, at best,

gas pipelines can be made hydrogen-ready with relatively little effort

compared to what was previously thought.

By Rystad Energy

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|