|

Big Oil

Is Hinting at Huge Gains for Clean Energy Investors

6 May 2023

Successful investors invest in generational

adaptations, and clean energy is an enormous one

-

To move beyond the 2022 global energy

crisis, the

world has been forced to adapt – to reimagine its global energy

ecosystem and restructure supply chains to produce more reliable

energy.

-

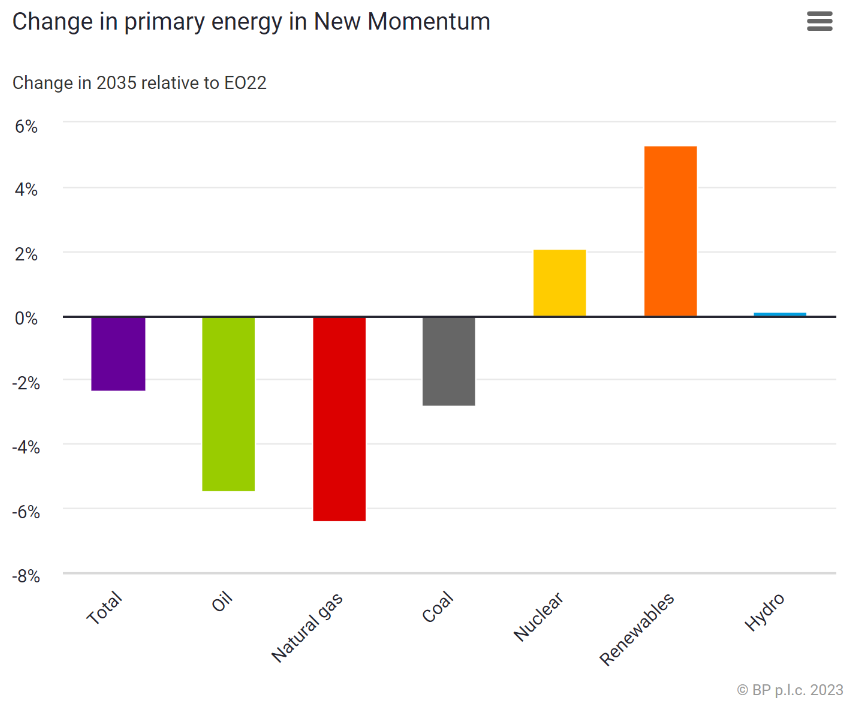

BP increased

its long-term demand forecasts for renewable energies by about 5% –

and cut its long-term demand forecasts for fossil fuels by about 5%

– from its 2022 outlook.

-

We think 2023 will be the year

of the comeback for high-risk stocks. And that’s why we think it is

time to start buying them.

Source: RoseStudio / Shutterstock

Editor’s note: “Big Oil Is Hinting at Huge Gains for Clean Energy

Investors” was previously published in February 2023. It has since

been updated to include the most relevant information available.

If we fail to adapt,

we fail to move forward.

So said

legendary UCLA basketball coach John Wooden, who won 10 national

championships in just 12 years – a record that hasn’t been touched

since and likely never will be again.

I remember

hearing that quote as an 8-year-old at a summer basketball camp.

It inspired me

then. And it inspires me now – so much so that the quote, in many

senses, has been my guide to investing.

As a society,

we must adapt to move forward.

If we want to

be successful investors, then we should identify the adaptations

society is making to move forward and invest in them.

Invest in change.

In fact, one

of the greatest investment opportunities we’re presented with today

involves such change on a massive scale.

And the 2022

global energy crisis has kicked it into overdrive.

The Hypergrowth Clean Energy Transition

It’s been a

year since Russia launched its invasion of Ukraine. Over those 12

months, the world suffered through an enormous energy crisis. And to

move beyond this crisis, the world has been forced to adapt – to

reimagine its global energy ecosystem and restructure supply chains to

produce more reliable energy.

Governments

and corporations across the world have been faced with two decisions.

Either pump more fossil fuels, or accelerate the development of

locally sourced alternative energies.

The

overwhelming majority of governments and corporations chose the

latter: Accelerate

the development and deployment of solar, wind, hydrogen, electric

vehicles, energy storage, and more.

Last year, the

U.S. passed legislation to accelerate the transition to renewable

energies. So did the European Union, Japan, China, Australia, and

pretty much every major economic powerhouse in the world.

In total, that

poured a record $1.4 trillion into the clean energy sector – a

significant increase from 2021.

Source: IEA

In order to

move forward, society must adapt.

In 2022,

society adapted by accelerating the global transition to clean

energies.

Even oil

companies agree on this regard.

In its 2023

energy outlook report released last week, Oil titan BP (BP)

– a $100 billion fossil fuel powerhouse that is among the largest and

most powerful energy firms in the world – said:

The company

increased its long-term demand forecasts for renewable energies by

about 5% – and cut its long-term demand forecasts for fossil fuels by

about 5% – from its 2022 outlook.

“The increased importance placed on energy

security as a result of the Russia-Ukraine war leads over time to a

shift away from imported fossil fuels towards locally produced

non-fossil fuels, accelerating the energy transition.”

The company increased its long-term demand

forecasts for renewable energies by about 5% – and cut its long-term

demand forecasts for fossil fuels by about 5% – from its 2022 outlook.

Source: BP

The Final Word

The Clean Energy Revolution has accelerated. Even the oil titans

agree. This is the adaptation the world has chosen to move forward

from the 2022 global energy crisis.

Successful investors invest in generational adaptations.

If you haven’t already moved with them, you need to do so right now.

Luckily, we have the perfect stock for you – but only if you’re

willing to take on some risk.

We think 2023 will be the year of the comeback for high-risk stocks.

And that’s why we think it is time to start buying them.

We’re very excited about the potential rewards here.

In particular, we’re really excited about one tiny next-gen vehicle

stock that we believe has arguably the biggest potential of any in the

market right now – not just over the next 12 months, but over the next

few years, too.

Our industry connections tell us that the technology this company is

perfecting today is world-class. In fact, it’s so good that we think

the biggest company in the world may be interested in getting in on a

piece of the action.

Needless to say, this is one of the most interesting stocks in the

market.

And the timing is perfect to buy.

Learn how to best capitalize on this boom.

On the date of publication, Luke Lango did not have

(either directly or indirectly) any positions in the securities

mentioned in this article.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

509 995 1879

Cell, Pacific Time Zone.

General office:

509-254

6854

4501 East Trent

Ave.

Spokane, WA 99212

|