|

14 April 2023

By

John Kingston

Amogy: Don’t burn hydrogen, split ammonia instead

Tugboat powered by ammonia to come after tests with

drone and truck

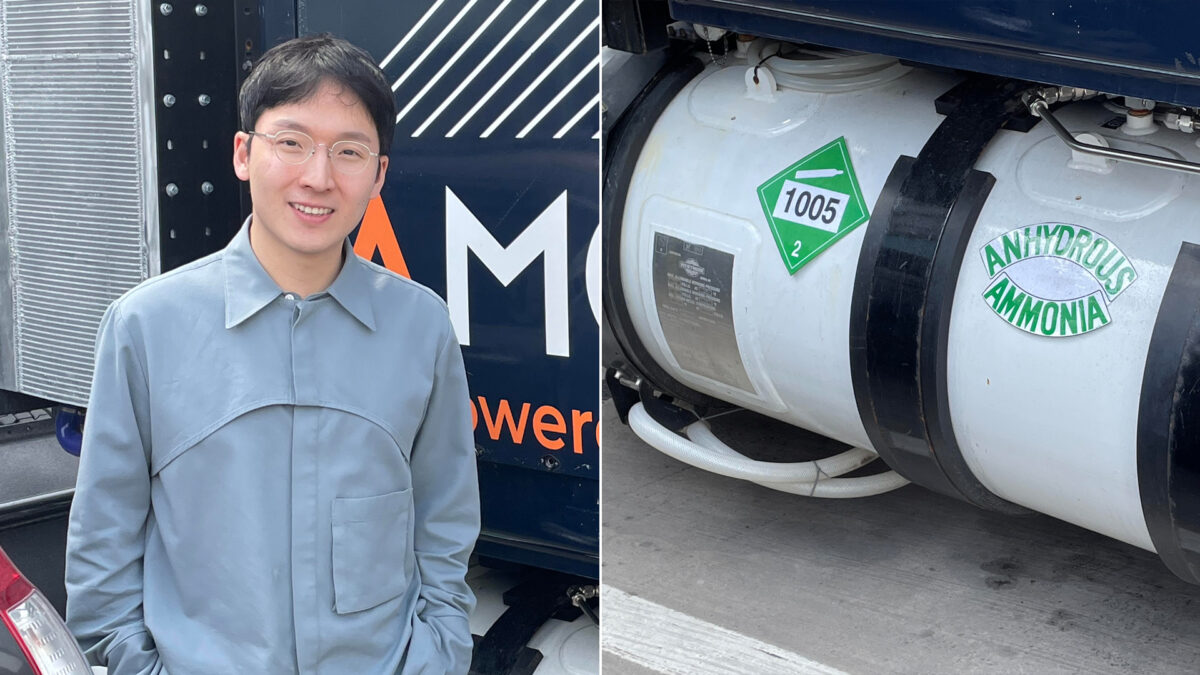

Left, Seonghoon Woo, CEO of Amogy in

front of the demonstration truck for its ammonia test; right, an

ammonium tank on that truck.

(Photo: FreightWaves)

The future of hydrogen

as a transportation fuel has numerous hurdles to climb, but one of

the most basic is just how it gets used in an engine.

Most of the focus has been on the debate between combustion — using

hydrogen in an internal combustion engine engineered for it — or

injecting it into an onboard storage tank where it is then fed into a

fuel cell. The fuel cell generates electricity and the waste product

is water.

Both have environmental issues. Combustion of hydrogen creates

problematic emissions of nitrous oxide. Hydrogen in a fuel cell hasn’t

improved emissions if the hydrogen was produced using electricity

generated from a fossil fuel.

But there is a third option that is being pursued by some companies,

with a well-funded startup called Amogy based in Brooklyn — yes,

Brooklyn, New York — preparing for an on-the-water test of its

approach later this year on the Hudson River.

The Amogy process involves using ammonia, which is made up of hydrogen

and nitrogen. But instead of combusting ammonia or injecting it into a

fuel cell, the technology behind the Amogy plan is to crack the

ammonia into the separate hydrogen and nitrogen molecules — with

nitrogen vented into the atmosphere, where it is already the largest

element — and then use the pure hydrogen as a fuel to be injected into

a fuel cell. The electricity coming off the fuel cell would then power

an electric drivetrain.

Amogy’s business model is based on the idea of using ammonia built

from green hydrogen, the industry’s term for hydrogen produced from

renewable sources like wind and solar. If the hydrogen from the

ammonia can be mapped back to one of those sources, then it can wear

the badge of green hydrogen and be eligible for several key benefits:

It can receive various tax breaks, and companies looking to meet a

low-emission or zero-emission goal can count its consumption toward

meeting that target.

It’s a plan that recently pulled

in almost $140 million in new venture capital funding. Investors

include the Saudi state oil company’s VC arm, Aramco Ventures.

“We see through our partnerships with the producer side that ammonia

is going to be more available in the future,” Amogy CEO Seonghoon Woo

said in an interview with FreightWaves at the company’s offices at the

Brooklyn Navy Yard, the site of ship construction years ago but now an

incubator for startups like Amogy.

Specifically, with world ammonia supplies now

somewhere between 200 million and 250 million tons per year, Woo said

based on projects in the pipeline, supplies should rise another 100

million tons by 2030.

But even though a lot of work is getting done in Brooklyn, the target

of all this effort is a test later this year north of New York City on

the Hudson River. It will be the third live test of the Amogy system

in which a form of transportation — in this case a tugboat — will be

powered by the Amogy cracker/fuel cell combination.

The first, Woo said, was a truck. The second was a drone. An existing

piece of equipment was used in both instances, and they are both

onsite at the Navy Yard.

The tugboat is being retrofitted north of New York City on the Hudson

River, preparing for a 12-hour journey that is likely in the fall,

according to Woo. The duration of that voyage will test the ability of

the Amogy system under more real-life conditions than for the drone

and Class 8 tractor.

Woo said the tugboat test will require the production of more

electrical output than the other tests and also gauge the ability of

the system on the open water, with the challenges that vibrations and

environment pose there. The 12-hour duration is expected to be the

capacity of the ammonia onboard.

The arguments Woo makes against the alternative ways of the use of

hydrogen besides ammonia were extensively discussed at the recent

CERAWeek by S&P Global conference in Houston, where one speaker joked

that the conference should be renamed Hydrogen Week since the fuel was

such a major topic of discussion.

The most common “con” observations heard about hydrogen mostly are

centered on issues of storage, infrastructure, transportation and

density, which were the same challenges the energy world has conquered

with natural gas and the growing market for LNG.

But for ammonia advocates like Woo, the difference between the LNG

transition and ammonia is that the latter is already an extensively

used product worldwide and it’s liquid at room temperature. Ammonia

transportation is a fully developed market, as the human-made compound

has long been a vital fertilizer.

Amogy has a far-flung footprint, a function in part of regulation and

where it sees its future opportunities. Beyond the headquarters in

Brooklyn, and the work on the tugboat near Albany, New York, it is

also building a manufacturing facility in Houston that will construct

the Amogy cracking system. The core of that system is a

ruthenium-based catalyst for the cracking process. Ruthenium, a

platinum-group metal, is now about $465 per ounce. At the start of

2018, it was less than $200 per ounce.

But the focus of much of Amogy’s work, according to Woo, is Norway.

It’s one of the world’s major locales for international shipping

companies and it has some of the most stringent rules for

decarbonizing marine traffic.

“Norway wants to decarbonize shipping by 2030,” Woo said. A move to

LNG-fueled shipping in recent years has moved that process along, “but

we came to the point where everybody understands we have to change the

fuel, and ammonia is recognized as one of the most important parts of

the fuel of the future.

“We are piggybacking on mature fuel cell technology so we can go to

market first,” Woo said.

As a result, Woo said, he would expect the first deployment of the

Amogy system to be in Norway.

There’s another factor that would push ammonia

adoption in Norway first: the price of carbon. The U.S. has no

carbon-trading system, but the European emission trading system does.

At 100

euros per metric ton recently, the

price of carbon is near all-time highs. (The dollar equivalent at

current exchange rates would be about $110 per metric ton.)

“So long as the price of carbon is near 70 or 80 [euros], it can give

us price parity to diesel,” Woo said, adding that Amogy envisions the

price of carbon going to 200 euros by 2030, “and that’s what gives us

confidence.”

And on the other side of the ocean, Woo said he sees the $3 per

kilogram credit for green hydrogen in the Inflation Reduction Act,

combined with other incentives to spur infrastructure such as hydrogen

hubs, as providing a huge lift to the hydrogen industry and ammonia by

extension. And while there may be no U.S. carbon tax, Woo said

companies with internal decarbonization targets generally have an

internal cost of carbon that is used in their calculations.

Looming in the background is the International

Maritime Organization, with its aggressive shipping decarbonization

targets for 2030 and 2050 and a growing consensus that hydrogen,

in one form or another, wlll be key to meeting those goals.

The overriding goal in hydrogen is “diesel parity,” a phrase that is

at the center of any discussion of hydrogen’s viability as an

alternative fuel. A kilogram of hydrogen and a gallon of diesel both

have about the same amount of energy, so the comparison between the

two is relatively easy.

The cost of producing hydrogen varies wildly

around the world. S&P Global Commodities Insights has set up a hydrogen

“wall” with costs around the world,

illustrating the vast differences.

But Woo notes that just making green hydrogen isn’t the end of the

process. Saudi Arabia and Australia are considered some of the

lowest-cost producers in the world, but to get the hydrogen to market

involves moving it as a gas with all of the issues that entails. The

Amogy value proposition circles back to the argument that Woo makes:

The transportation of ammonia and its embedded hydrogen molecules is

likely to make that form the solution for a hydrogen-based energy

transition.

Woo noted that ammonia is not without its shortcomings in some

applications. It’s toxic and using it for passenger vehicles, with all

of the human foibles that can accompany people filling up their cars,

could be particularly dangerous if ammonia is the fuel. Those issues

are more easily managed if the refueling is done under professional

conditions, rather than personal handling.

Green Play Ammonia™, Yielder® NFuel Energy.

Spokane, Washington. 99212

www.exactrix.com

509 995 1879 cell, Pacific.

exactrix@exactrix.com

|